The Bank Nifty, a benchmark index representing the Indian banking sector, is a popular choice for traders due to its volatility and potential for significant returns. To effectively analyze Banknifty charts and develop profitable trading strategies, it’s essential to understand key technical indicators, and charting techniques, and incorporate insights from the F&O Stock List.

Understanding Banknifty Charts

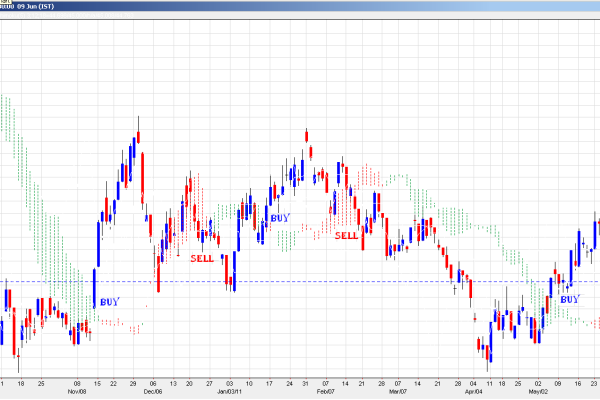

Banknifty charts depict the price movements of the index over time, providing valuable information for traders. By studying these charts, you can identify trends, support and resistance levels, and potential trading opportunities. Popular chart types include candlestick charts, bar charts, and line charts. Integrating data from the F&O Stock List into your Banknifty analysis can offer additional insights, as it highlights stocks with high liquidity and volatility that could impact the overall index.

Key Technical Indicators for Banknifty Analysis

Several technical indicators are crucial for analyzing Banknifty charts:

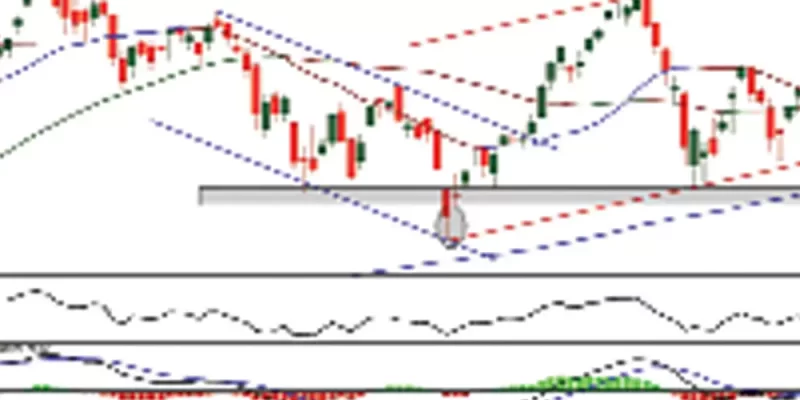

Moving averages, including the Simple Moving Average (SMA) and Exponential Moving Average (EMA), smooth out price fluctuations and help identify trends in the Banknifty. Incorporating stocks from the F&O Stock List into this analysis can enhance your understanding of broader market trends and individual stock performance. RSI measures the speed and change of price movements, helping to identify overbought or oversold conditions in the Banknifty. Reviewing the F&O Stock List alongside RSI can provide insights into which stocks might be driving the index’s movements.

Bollinger Bands plot a moving average with two standard deviation bands around it. They help identify potential reversals and volatility in the Banknifty, with the F&O Stock List providing additional context for significant price movements. Moving Average Convergence Divergence or MACD compares two moving averages to identify trend changes and potential buy or sell signals. Using this indicator in conjunction with the F&O Stock List can help pinpoint stocks that are contributing to the Banknifty’s performance.

Analysing Banknifty Charts with Trading Apps

Share Trading apps offer advanced tools for analyzing Banknifty chart, including real-time price data, technical indicators, and chart customization options. These apps can integrate data from the F&O Stock List, allowing you to track the performance of key stocks and their impact on the Banknifty. By utilizing these tools, you can develop a more comprehensive trading strategy.

Developing Trading Strategies

Based on your analysis of the Banknifty charts and the F&O Stock List, you can develop various trading strategies:

- Trend Following: Identify the prevailing trend (uptrend, downtrend, or sideways) and trade in the direction of the trend. Stocks from the F&O Stock List that align with this trend can provide additional trading opportunities.

- Mean Reversion: Look for opportunities to profit from price reversals when the Banknifty is overbought or oversold. The F&O Stock List can help you identify specific stocks that might experience similar reversals.

- Support and Resistance: Identify key support and resistance levels on the Banknifty chart. These levels can act as potential entry and exit points, with stocks from the F&O Stock List providing further context.

- Option Strategies: Consider using options contracts to manage risk and enhance returns. The F&O Stock List can guide you in selecting stocks for your options strategies.

Conclusion

Analyzing Banknifty charts requires a blend of technical skills, market knowledge, and an understanding of the F&O Stock List. By utilizing these tools and strategies, you can increase your chances of success in the Banknifty market. Remember, trading involves risks, and past performance is not indicative of future results.

Comments