If you have lately started the stock market, you have probably heard the term “Nifty 50 option chain” before. Though it seems complicated, traders just apply this basic tool to make sensible decisions about buying or selling options. This study will address the operations and relative benefits of the Nifty 50 option chain combined with its coverage by the Bank Nifty option chain.

About Nifty 50 Options

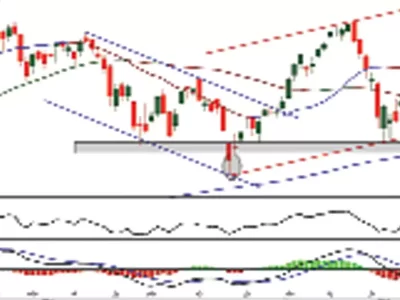

The most renowned stock market indices in India, the Nifty 50 comprises of fifty businesses traded on the National Stock Exchange (NSE). Presenting the numerous possibilities for the Nifty 50 index, the Nifty 50 option chain is a table or chart. Since options are a form of derivative, this chain reveals for investors what market attitude and value could be for the Nifty 50.

In this case, the Nifty 50 index, an option contract, permits the buyer the right but not the duty to buy or sell the connected asset, that is, at a certain price before a specified date. Presenting investors the predictable direction of the market, the option chain reveals call and put choices. A call option lets an investor buy the index at a specified price; a put option allows him to sell at the same price.

Understanding The Nifty 50 Option Chain

Initially, the Nifty 50 option chain seems to be a set of technical words and statistical data collection tools. Once you understand its framework, though, it turns into a helpful tool for directing financial decisions.

Call option data to the left of the strike price; put option data runs to the right. It has information like:

- Price of the option

- Interest

- Number of active contracts

- Ending date of the contract

This information enables traders to identify market activities and evaluate possible risks or profits.

Why Use The Nifty 50 Option Chain?

The Nifty 50 choice chain turns out to be useful for various reasons. It offers, first of all, real-time market statistics. The chain lets traders evaluate investor attitude, thereby influencing their decisions on whether more people hope the market will rise or fall. Second, it supports control of risk.

Using the option chain, traders can gamble on the direction of the market, hoping to make money from their forecasts. Although they have probable return, alternatives can be damaging; therefore, one should use them cleverly.

The Bank Nifty option chain focus on the banking industry, while the Nifty 50 covers a wide spectrum of enterprises. Major Banks make up the Bank Nifty index.

Conclusion

The Nifty 50 option chain helps both beginner and experienced traders take hold of the market. If your targets are to hedge your bets, gamble on market fluctuations, or even get insight into trends, knowing and applying the option chain will assist you in improving your trading method.

Comments